For a strong economic recovery, invest in financial resilience

- Financial resilience — the ability to deal with an unexpected loss of income or financial emergency — was low even before the COVID-19 pandemic.

- Even in high-income countries, many people are unable to come up with a relatively large sum of cash quickly.

- To fix this and improve financial resilience, states should strengthen public safety nets and encourage people to increase their savings.

Long before the COVID-19 pandemic upended economies and household budgets worldwide, a substantial share of households in Europe, the United States and Canada would have struggled financially confronted with a financial emergency, such as a loss of income or an accident.

More recently, the Global Findex 2021 asked adults in developing and high-income countries about their degree of financial resilience, defined as the ability to come up with emergency money equivalent to 5% of gross national income — around $3,300 in the US — within 30 days without difficulty. To put the figure into context, it is just over half a month of income for the median US household in 2021.

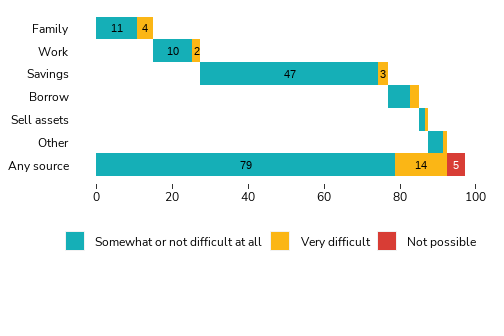

The Global Findex brought some positive news: 79% of adults in high-income economies could come up with the money with relative ease. When the time frame shrinks from a month to a week, 68% of adults could come up with the money, while 14% of adults would struggle even with a month’s time. For 5% it would be impossible.

Financial resilience in high-income countries

Nearly 20% of adults in high-income countries lack financial resilience.

These financial challenges bring stress and can have long-term consequences. In the US, some turn to predatory lenders in the face of financial shortfalls, with fees that can easily exceed the amount borrowed. The US Financial Diaries and the Federal Reserve’s SHED report document other costly strategies, including people coping with illiquidity by postponing visits to doctors and by not taking costly but necessary medicines. In 2022, hardship withdrawals and loans from retirement accounts increased, suggesting that more households are in urgent need of cash.

The first step to increased resilience is anticipation

To understand why and what can be done to increase financial resilience, it’s worth considering what we mean by “unexpected” or “emergency” expenses.

The words imply that they are surprises and therefore cannot be planned for, but the reality is more nuanced. In fact, financial “emergencies” are quite common. Pew finds that 60% of families faced one in the previous year, and one-third faced two. While it is true that people cannot predict exactly when these events will happen, they can anticipate that some sort of emergency is likely to happen — and can, in principle, prepare.

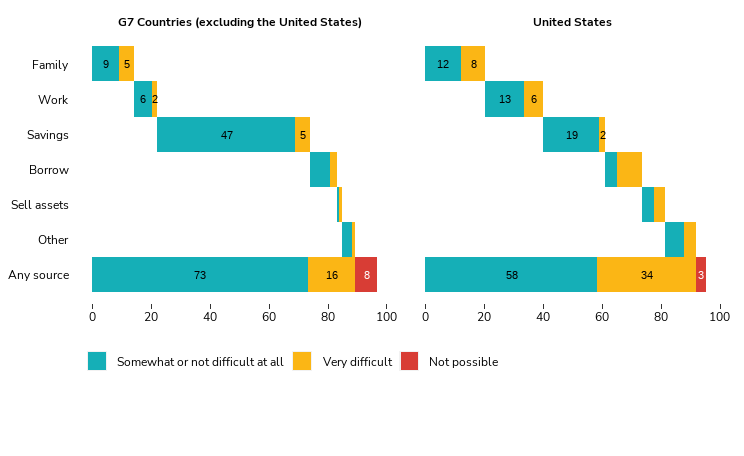

Poorer adults in the US are less resilient than poorer adults in other G7 countries.

One of the most common tools to help households manage extra expenses is household savings. The Global Findex 2021 data on financial resilience found that savings are the most common source of funds for adults who can come up with the money easily.

Saving is harder for households with less income, however. In the United States, the bottom 40% include households with an annual household income of less than $110,000. While these households are “poorer,” most are not actually poor — the official US poverty threshold was $33,150 in 2021. Still, their ability to turn to savings is far more limited than comparable households in other high-income economies: 19% of poorer Americans report that they could reliably draw on savings during an emergency compared to 47% of households in other G7 countries. 19% of poorer Americans say they would find extra work — although, perhaps unsurprisingly in today’s gig economy, about a third say it’s unlikely they could come up with the money. An additional 12% of poorer adults say they would depend on credit in an emergency, although the majority of those expectant borrowers also say it would be very difficult to get the money in this way.

Improving financial resilience through savings and inducements to save

Increasing resilience through savings requires a three-part strategy that includes access to savings accounts, inducements to save and, perhaps, financial education.

Account access is generally high in high-income economies, with 96% of adults owning a formal account, according to Global Findex data. Still, in the United States, 11% of African American households and 9% of non-White Hispanic households lacked bank accounts in 2021. Global Findex data also found that only 58% of adults used an account to save in the 12 months prior to the survey. Other studies by the United States Federal Deposit Insurance Corporation and the US Consumer Financial Protection Bureau find similar gaps.

The low rates of savings can be partially explained by the negative economic shock of the COVID-19 pandemic. In times of heightened financial pressure, it makes sense that people have drawn down their savings or added little to existing accounts. Yet research also shows that even very low-income adults can save consistently, given the tools and incentives to do so. For example, employer-sponsored payroll deduction savings accounts or other auto-deposit savings programmes.

Financial education and literacy might also play a role. Multiple studies have found that people with stronger general education as well as greater financial literacy are more likely to save and invest, although the direction of causality is hard to nail down.

Creating workable strategies, starting today

Addressing the challenges should not fall only on struggling households. Governments should strengthen safety nets and ensure that all households have affordable healthcare and reliable, transparent financial options that minimise risks.

But as the Global Findex shows, households need workable strategies as well. Given the widespread, macro-economic challenges that continue to plague economic policymakers, it is the right time to prioritise programmes that will help households build robust financial cushions.

Read the full piece at We Forum here.